The Finnish Startup Community (FSC), Tesi, and the Finnish Venture Capital Association (FVCA) have published a new study on the Finnish startup ecosystem. The study identified over 4,200 startup-based firms in Finland, generating more than €12.5 billion in revenue and employing 47,000 people globally. These figures underline that technology-driven startups already play a major role in Finland’s economy, and the country’s future growth will increasingly depend on their ability to scale.

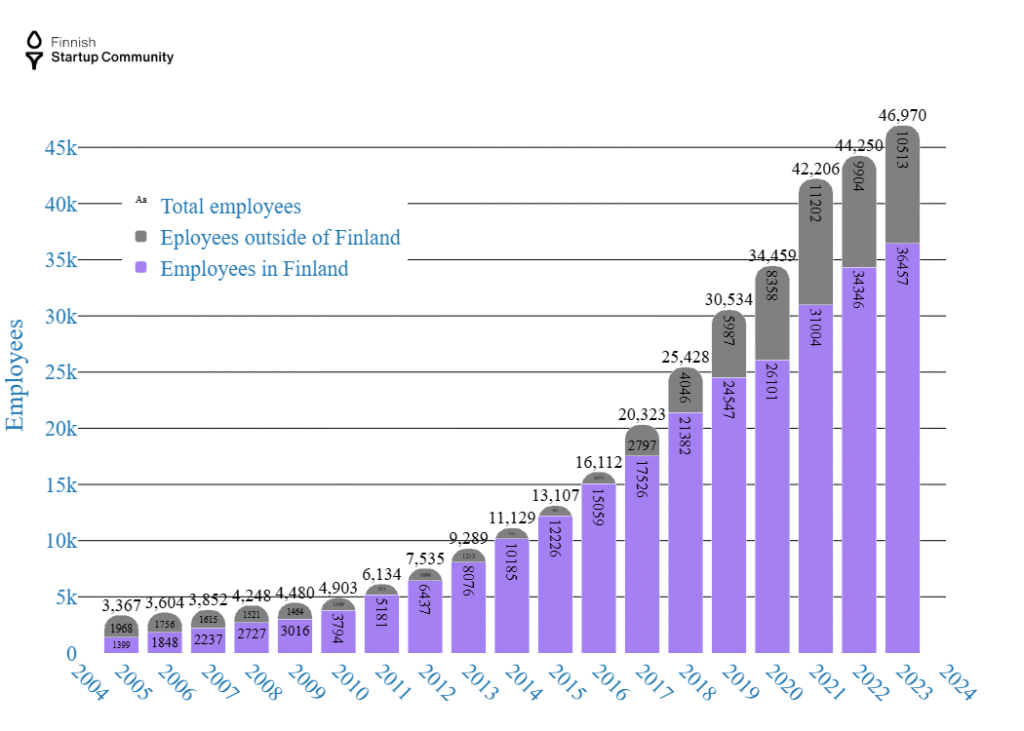

To put these numbers in perspective, our recent analysis shows that Finnish startup-based firms employed approximately 47,000 people in 2023, of which an estimated 36,000 worked in Finland. For comparison, one of Finland’s cornerstone industries — the forest sector — directly employed around 38,000 people domestically in 2021 (Finnish Forest Industries). Although more recent data for the forest sector are not yet available, this comparison suggests that, in terms of direct employment, the Finnish startup ecosystem has already reached a scale comparable to the forest industry.

In Figure 1, we present the total number of employees in Finnish startup-based firms, distinguishing between workers located in Finland (purple bars) and abroad (grey bars). The figure illustrates that the majority of startup employment seems to be domestic, underscoring the ecosystem’s strong national footprint even as global expansion accelerates.

Figure 1: Employees in Finnish startup-based firms 2005-2023 (Finnish Startup Community, Statistics Finland, 2025)

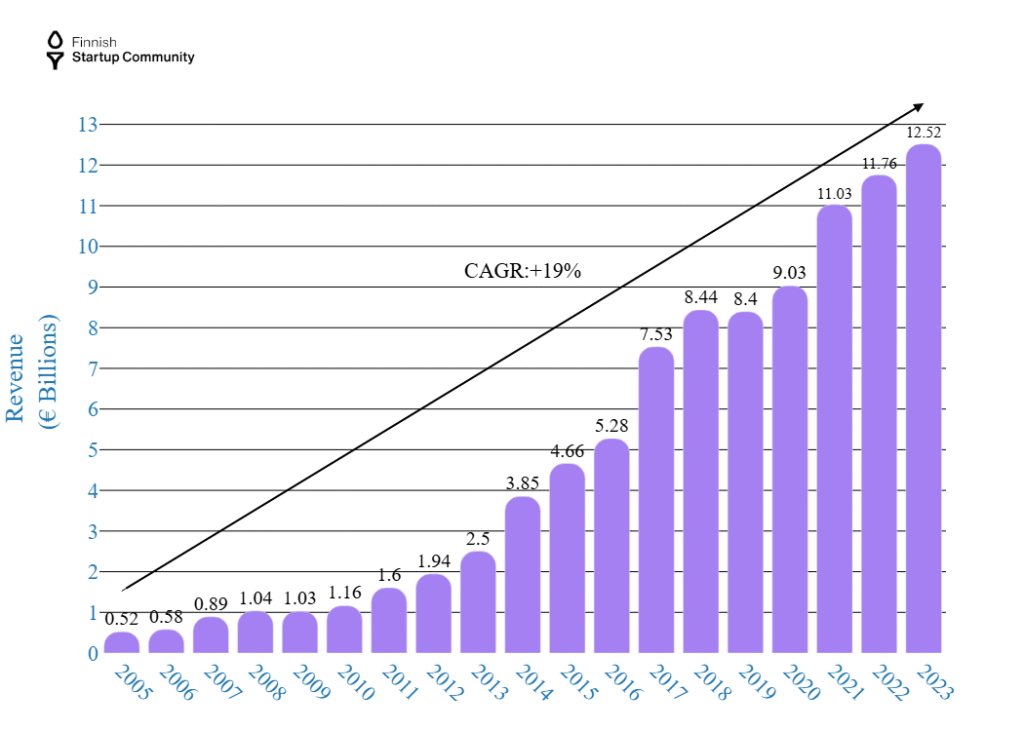

According to our data, the revenue of startup-based firms has grown remarkably over the past two decades. In 2005, their combined revenue was around €520 million. With a compound annual growth rate (CAGR) exceeding 19 percent, these firms generated approximately €12.5 billion in 2023.

According to a recent survey of FSC members, the majority of the revenue comes from exports, as large as 95 percent. However, this figure reflects only the responding firms and may not fully represent the entire startup population analyzed in the official study.

In Figure 2, we present the total revenue of the startup-based firms included in our study. It is worth noting that while revenue has grown substantially, so has the number of firms in the population being analyzed. The annual revenue figures shown here differ slightly from those in the joint startup study, as this analysis relies on Statistics Finland as the primary data source, whereas the earlier study combined several sources. Despite these minor differences, the overall trend remains the same — a clear, sustained growth of the Finnish startup ecosystem.

Strikingly, at the current growth rate, Finland’s startup ecosystem could generate more than €40 billion in revenue in the coming years. I had to run the numbers several times in Excel — and even double-check them with ChatGPT — just to be sure. Exponential growth is notoriously hard to grasp, yet it’s exactly what we see in the mystical world of startups, scaleups, centaurs, and unicorns.

Even under a far more conservative scenario — with the ecosystem growing by only about €1.1 billion per year — total revenue would still exceed €20 billion by 2030.

Fig 2: Revenue in Finnish startup-based firms in 2005-2023 (Finnish Startup Community, Tesi, Fvca, Statistics Finland, 2025)

Today’s R&D shapes tomorrow’s growth — and startups’ potential looks enormous

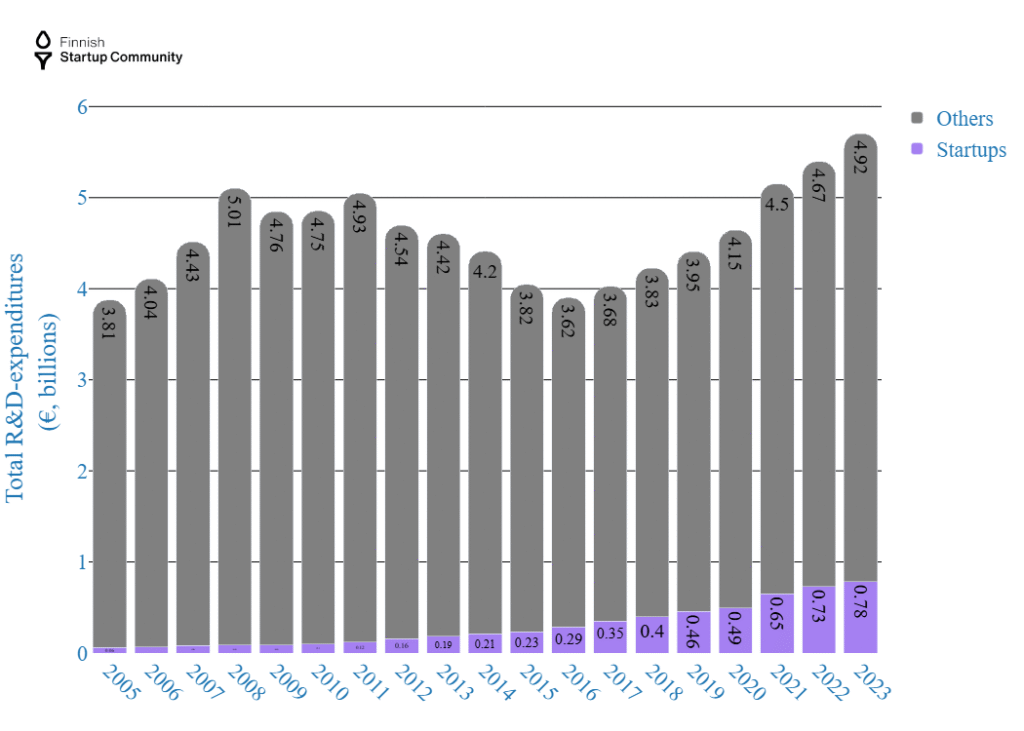

Finally, I wanted to look at something that didn’t make it into the official study — R&D investments by startups. The numbers were simply too interesting to ignore. Using firm-level data from Statistics Finland, we linked our startup list to official R&D datasets to see how much these firms actually invest in innovation.

The result surprised even me: in 2023, startup-based firms spent around €800 million on R&D. For context, total R&D spending across the entire Finnish business sector was about €5.7 billion — meaning startups alone contributed roughly 14 percent of it. That’s remarkable for a group of only 4,200 companies. After Nokia, it’s fair to say that Finland’s startup ecosystem is now the country’s second-largest engine of R&D investment.

Figure 3 illustrates the yearly R&D investments of startup-based firms in Finland. The compound annual growth rate is slower than for revenue but still strong. In 2005, startups invested about €63 million in R&D; by 2023, that figure had risen to €785 million. This steady growth suggests that these firms continue to see significant opportunities for research, innovation, and long-term gains.

Figure 3: Yearly R&D investments of startup-based firms in Finland during 2005-2023 (Finnish Startup Community, 2025)

Following the global financial crisis of 2008–2009, overall business R&D expenditure (BERD) in Finland declined and remained relatively flat for nearly a decade. While large industrial players scaled back their R&D spending, startup-based firms continued to invest steadily, even through periods of economic uncertainty. This persistence underscores how Finland’s innovation landscape has gradually shifted — from being dominated by a few major corporations to being powered by a broader base of emerging technology firms.

Interestingly, although the growth in startup R&D is clear, part of the increase likely reflects the expanding number of startups in the ecosystem rather than rising per-firm investments. In other words, what we’re seeing is not just deeper innovation spending, but also wider participation in R&D — a healthy sign of ecosystem maturity.

Visually, the purple bars representing startups may look small next to the total R&D volume, but their relative growth rate tells a more dynamic story. Startups have managed to sustain and expand their R&D activities even when total business R&D lagged behind. This suggests that the next generation of Finnish innovation capacity may increasingly come from these young, agile firms rather than traditional industrial giants.

Figure 4. R&D investments of startup-based firms and other Finnish firms, 2005–2023 (Sources: Statistics Finland; Finnish Startup Community, 2025)

Some of the data presented in this blog are based on the joint startup study by the Finnish Startup Community, Tesi, and Finnish Venture Capital Association. You can download the full report from the link below.

Youssef Zad

Chief Economist

Finnish Startup Community

Amir Hassan

Economist

Finnish Startup Community